Introduction to Fund Finance

Fund finance refers to the financial services provided to investment funds, including private equity, hedge funds Real Estate Investment Trusts (REITs and other alternative investment vehicles. This comprehensive guide aims to shed light on the various aspects involving fund finance, providing a clear understanding of its benefits, types, and industry trends.

- A Brief History of Fund Finance: Fund finance has undergone a thrilling transformation in recent decades! Initially focused on traditional investments and lending it has now evolved to match the complexity and sophistication of financial markets and investor demands. The emergence of private equity and hedge funds in the late 20th century brought about pivotal shift, introducing intricate financing solutions and innovative instruments. Today, fund finance encompasses vast array of strategies such as leveraged buyouts, venture capital, and real estate investments, showcasing the dynamic nature of global financial markets.

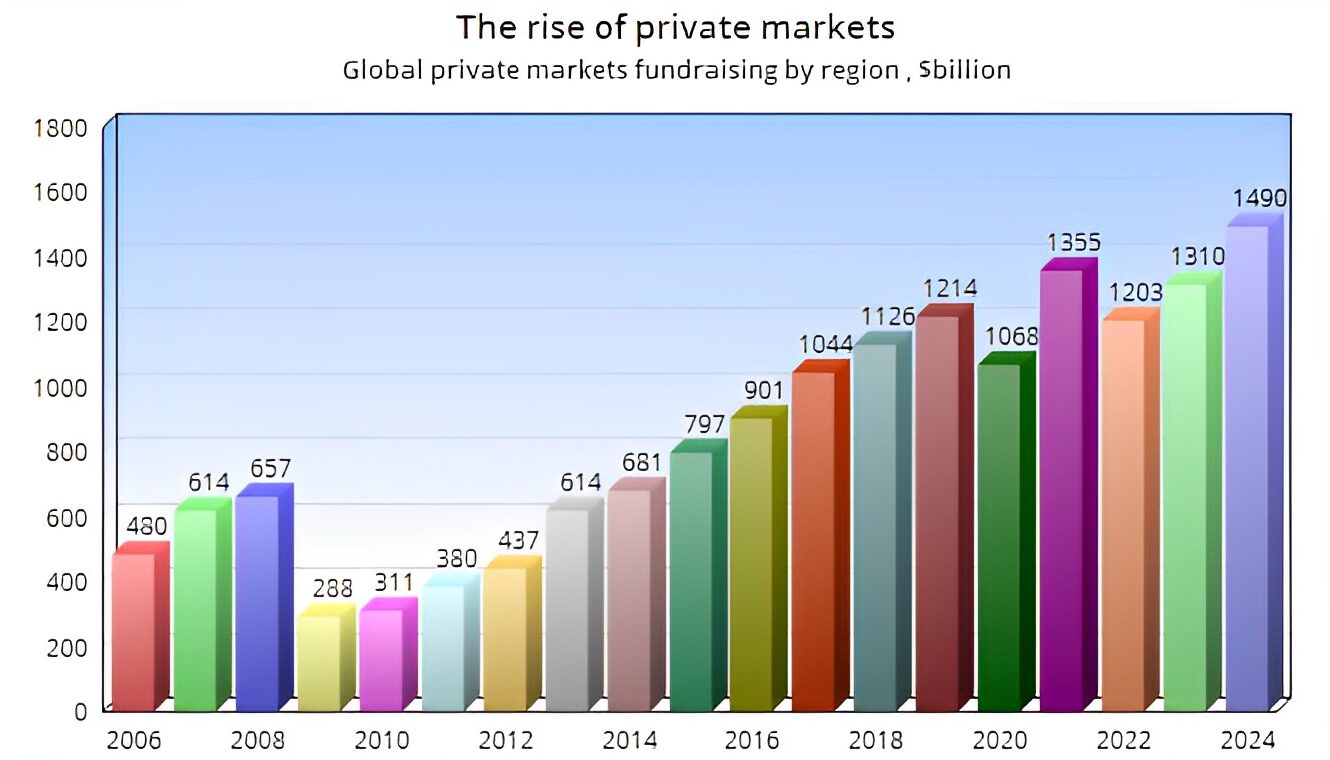

- A Decade of Growth in Alternatives: Over the past decade, the alternatives market has experienced robust growth. The increasing appetite for higher returns and diversification has driven investors towards private equity, hedge funds, and real assets. This growth is fueled by favorable market conditions, evolving investment strategies, and an expanding pool of institutional investors. As traditional asset classes face greater volatility, alternative investments have become a crucial component of diversified portfolios, contributing to the significant expansion and maturation of the fund finance industry.

Benefits of Fund Finance

Fund finance offers several benefits to both fund managers and investors. Firstly, it provides greater flexibility in managing cash flow. By securing financing against committed capital or unfunded commitments, fund managers can bridge the gap between making investments and receiving capital from limited partners. This enables them to seize investment opportunities promptly and maximize returns.

Secondly, fund finance can enhance return on investment for limited partners. Since fund managers can deploy capital more efficiently, they can potentially generate higher profits. Moreover, by mitigating liquidity risks, fund finance contributes to better overall fund performance, which is of paramount importance to investors.

Thirdly, fund finance helps in diversifying the investor base. By accommodating the needs of different investors, such as pension funds, endowments, and high net worth individuals, fund managers can attract a more varied pool of investors. This diversification can stabilize the fund’s capital base and reduce dependence on a limited number of investors.

Types of Fund Finance

There are several types of fund finance available to investment funds. One common type is subscription line financing, which allows fund managers to borrow against the future capital commitments made by limited partners. This type of financing is especially useful in bridging the timing gap between capital calls and actual contributions.

Another type is asset-based lending, where fund managers use the fund’s assets, such as real estate holdings, as collateral to secure loans. This form of financing is commonly used by real estate investment funds as it enables them to unlock additional liquidity without having to sell assets at unfavorable prices.

Additionally, there is also margin lending, where fund managers can borrow against the value of their investment portfolio. This type of financing is suitable for funds that have a significant amount of publicly traded securities and provides them with an additional source of liquidity.

Fundraising and Investor Relations

Fund finance plays a critical role in the fundraising process. By utilizing fund finance, fund managers can demonstrate to potential investors that they have the necessary resources to deliver on their investment strategies. Additionally, fund finance can also provide comfort to limited partners who may have concerns about the manager’s abilities to meet investment commitments.

Moreover, fund finances promotes better investor relations. By ensuring consistent and timely capital distributions, fund managers can improve communication and transparency with their investors. This, in turn, helps to build stronger relationships and establish trust with limited partners.

Fund Structuring and Formation

Fund finance is closely linked to the structuring and formation of investment funds. The availability of fund finances options can influence decisions such as the type of fund structure, choice of jurisdiction, and terms offered to limited partners. Fund managers must carefully consider these factors to optimize the overall fund structure and achieve desired outcomes.

Fund Documentation

Sound documentation is essential in fund finances transactions. Accurate and comprehensive documentation protects the interests of all parties involved and ensures clarity regarding capital commitments, loan terms, collateral arrangements, and any associated risk management provisions. Thorough due diligence and legal expertise are key requirements for creating robust fund documentation.

Fund Investments

Fund finance supports fund managers in making investments. By providing access to capital at the right time, fund finances enables managers to seize market opportunities and execute their investment strategies promptly. Whether it’s venture capital, private equity, or commercial real estate investments, fund finances can play a crucial role in driving successful investment outcomes.

Fund Performance and Reporting

Monitoring and reporting on fund performance is vital in fund finance. Investors rely on accurate and timely information about their investments to make informed decisions. Therefore, fund managers must implement effective reporting systems and provide comprehensive performance updates to maintain investor confidence.

Risk Management and Compliance

Fund finances incorporates risk management and compliance measures. Due to the nature of alternative investments, there are various risks involved, such as market, credit, and operational risks. Fund managers must have robust risk management systems in place to identify, assess, and mitigate these risks. Compliance with regulations is also crucial and requires ongoing monitoring and adherence to ensure legal and ethical practices.

Fund Exit Strategies

Having a well-defined exit strategy is crucial for both fund managers and investors. Fund finances can play a role in facilitating smooth exits by providing additional liquidity during the sell-down phase. This allows fund managers to optimize the terms of their exits and maximize returns for investors.

Industry Trends in Fund Finance

The world of fund finances is continuously evolving, driven by changing market dynamics, regulatory developments, and investor demands. Some current industry trends include a growing focus on environmental, social, and governance (ESG) factors, the rise of impact investing, and the increasing importance of cybersecurity in fund operations. Staying updated with these trends is vital for fund managers to navigate this dynamic landscape successfully.

Conclusion

Fund finance is a crucial component of the investment fund ecosystem. It offers numerous benefits such as enhancing cash flow flexibility, diversifying the investor base, and improving overall fund performance. By understanding the different types of fund finance, leveraging its benefits, and staying attuned to industry trends, fund managers can optimize their capital strategies and achieve successful investment outcomes.

Pingback: Understanding the Pros and Cons of In-House Financing Car Lots