In-House Financing Car Lots Introduction

In-House Financing Car Lots have become increasingly popular in recent years, especially among individuals with low credit scores who struggle to secure traditional auto loans. However, it is important to understand the pros and cons of this financing option before making a decision. This article aims to provide you with a comprehensive overview of in-house financing car lots.

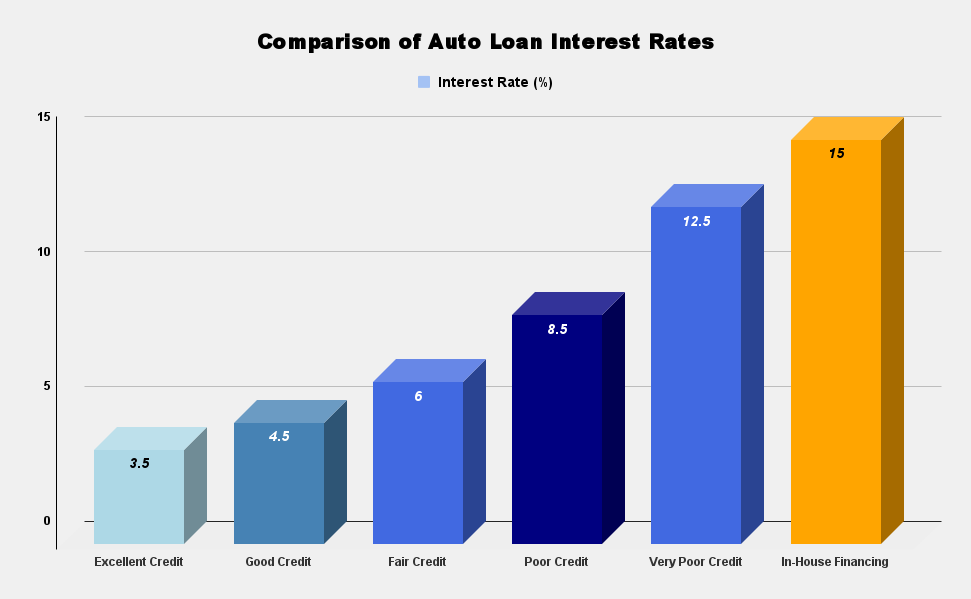

To better understand the variations in interest rates across different credit scores and of financing, please refer to the professional chart displayed below.

What are In-House Financing Car Lots?

In-House Financing Car Lots are dealerships that offer to finance their own vehicles. Unlike traditional car dealerships, they act as both the seller and the lender. This means that instead of relying on a third-party lender, such as a bank or credit union, the dealer finances the purchase directly. This approach offers some benefits as well as drawbacks, which we will discuss further in this article.

Pros of In-House Financing Car Lots

1. Flexibility in Approval Process

One of the significant advantages of in-house financing car lots is the flexibility in the approval process. These dealerships are often more lenient when it comes to credit scores and income verification. They consider other factors such as employment stability and willingness to make monthly payments, making it easier for individuals with low credit scores to get approved.

2. Option for Individuals with Low Credit Scores

In-house financing car lots provide an opportunity for individuals with low credit scores to own a vehicle. For those who have been turned down by traditional lenders due to poor credit history, these dealerships offer a viable alternative.

3. Simplified Documentation and Application

Applying for financing through an in-house financing car lot is usually straightforward. The documentation required is minimal, making the process quicker and more convenient. This is particularly beneficial for individuals who struggle with extensive paperwork or who need a vehicle urgently.

4. Faster Processing and Disbursement

In-house financing car lots often have faster processing times compared to traditional lenders. They have a streamlined system that allows for quicker loan approvals, leading to faster disbursement of funds and ultimately getting you behind the wheel of your desired vehicle sooner.

5. Greater Chance of Approval

As mentioned earlier, in-house financing car lots have a higher approval rate compared to traditional lenders. They take into account factors beyond just credit scores, increasing the chances of approval for individuals who may not meet the strict criteria set by banks or other financial institutions.

Cons of In-House Financing Car Lots

1. Higher Interest Rates

One of the main drawbacks of in-house financing cars lots is the higher interest rates they often charge. Since these dealerships are taking on higher risk customers, they compensate by charging higher interest rates. It is crucial to carefully consider the additional cost that comes with these higher rates, as it can significantly impact your overall budget.

2. Limited Vehicle Options

In-house financing cars lots typically have a limited inventory compared to traditional dealerships. This means that you may have a narrower selection when it comes to choosing the make, model, or trim level of the vehicle you want. This limited availability might make it more challenging to find a vehicle that perfectly fits your preferences.

3. Potential for Unreliable Vehicles

Due to the nature of in-house financing cars lots, there is a possibility of purchasing vehicles with undisclosed issues or mechanical problems. Some dealers may prioritize profit over product quality, resulting in a potential risk of buying an unreliable vehicle. Conducting thorough research and getting a professional inspection is crucial when considering purchasing from these dealers.

4. Stricter Payment Terms

In-house financing cars lots often impose stricter payment terms compared to traditional lenders. These terms can include higher down payments, shorter loan durations, and inflexible repayment schedules. It is essential to carefully review and understand the terms and conditions before making a commitment, ensuring they align with your financial capabilities.

5. Limited Influence on Credit Building

While timely payments to in-house financing cars lots can contribute to improving your credit score, the impact may be limited. In some cases, these dealerships may not report to the major credit bureaus, which means your positive payment history might not translate into a significant improvement in your credit score. This limitation could potentially hinder your credit-building efforts.

Conclusion

In-house financing cars lots can be a viable option for individuals with low credit scores or those who face difficulties obtaining traditional auto loans. The flexibility in the approval process, simplified documentation, and faster processing times are some of the advantages they offer. However, it’s crucial to consider the higher interest rates, limited vehicle options, and potential for unreliable vehicles. Additionally, the stricter payment terms and limited influence on credit building should be taken into account. When deciding if in-house financing is right for you, it’s important to weigh both the pros and cons and consider your individual financial situation.